October 2023 Economic Review

October Economic Review

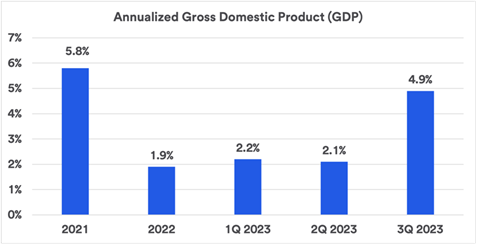

The US economy expanded at an annualised rate of 4.9% in the third quarter of 2023, mainly due to the expansion of job opportunities for the unemployed. The European Central Bank (ECB) kept interest rates unchanged at 4% at its October meeting, despite a weak economy. The decision to pause rates was taken after PMI data showed a slowdown in economic activity as well as a continued drop in inflation. Eurostat reported a euro zone economic contraction of 0.1%, which was below consensus estimates for GDP to remain unchanged from the previous quarter.

US Federal Reserve (Fed) Chair Jerome Powell indicated the Fed was taking a balanced approach to monetary policy and revealed a more dovish perspective ahead of the November meeting of the Federal Open Market Committee (FOMC). The International Monetary Fund (IMF) forecast that global growth would slow from 3% in 2023 to 2.9% in 2024. Hamas launched a major attack on Israel in early October: concerns that this would escalate into a regional conflict caused almost a 4% increase in Brent crude oil prices to around US$88 per barrel and 1% rise in gold prices. The South African Reserve Bank (SARB) warned that strained public finances were obstructing economic growth. It said reducing public debt to sustainable levels could yield benefits, including a lower cost of capital, reduced debt-service costs, and lower inflation.

The US economy expands in the third quarter

Although investors have feared a US recession, the US economy expanded at an annualised rate of 4.9% in the third quarter of 2023. The primary contributor to the expansion was the job market, where there were significantly more job openings for available workers. This resulted in an increase in consumer spending on goods of 4.8% and services of 3.6%. Additional contributors to GDP were increases in government spending and investment of 4.6% and gross private domestic investment of 8.4%. The US grew by 2.2% in the first quarter of 2023 and 2.1% in the second quarter, well above the forecast by Fed officials of a non-inflationary rate of 1.8%. This is lower than the fastest US growth rate recorded (since 1984) of 5.1% in 2021.

Source: US Bureau of Economic Analysis, October 2023

Although growth seems positive, there are still threats of a looming recession due to inflation and the consistently high interest rate. The New York Fed’s probability indicator still depicts a 56% probability of the US entering into a recession in the next 12 months, from a previous reading of 66% in August. The Fed has warned that interest rates will remain higher for longer, and it will need to tighten monetary policy to boost economic growth.

ECB pauses interest rates

The European Central Bank (ECB) kept interest rates unchanged at 4% at its October meeting, despite a weak economy. This is still an all-time-high figure for the euro zone after 10 consecutive increases. Interest rates from the main refinancing operations (providing the bulk of liquidity to the banking system) and marginal lending facility (offering overnight credit to banks from the Eurosystem) remained at 4.50% and 4.75% respectively. The decision to pause rates was taken after PMI data showed a slowdown in economic activity as well as a continued drop in inflation. The PMI index declined to 46.5 in October from 47.2 in September, reflecting a 0.1% decline in the German economy and job cuts by numerous companies, which led to a steep decline in economic output.

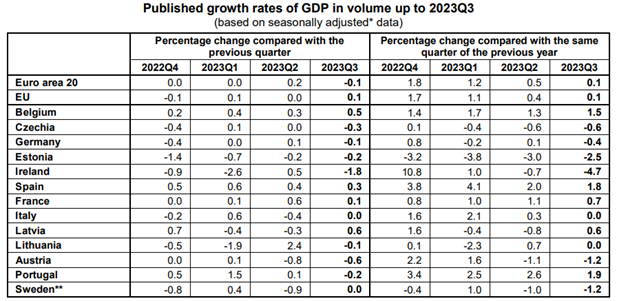

Euro zone economy shrinks

ECB President Christine Lagarde warned that the risks to Europe’s economic growth remain tilted to the downside and the euro area’s economy is likely to remain weaker for the remainder of the year. Eurostat reported a eurozone economic contraction of 0.1%, below consensus estimates for GDP to be unchanged from the previous quarter. The ECB expects the euro zone economy will expand by 0.7% for the remainder of 2023, 1% for 2024 and 1.5% in 2025. Euro zone inflation dropped to 2.9% in October from 4.3% in September. This means the euro zone is close to achieving the ECB’s inflation target of 2% and this adds to expectations that the interest rate hiking cycle might end. The ECB has said it would need to maintain its key rates at levels that will allow it to reach its inflation target.

Source: Eurostat, October 2023

US Fed Chair’s balanced monetary policy outlook

US Fed Chair Jerome Powell’s speech at the Economic Club of New York indicated a balanced approach to monetary policy. While his initial remarks leaned towards a hawkish stance, his responses revealed to be more dovish ahead of the FOMC’s November meeting. Powell acknowledged progress in curbing inflation but emphasised the need for caution due to existing risks and the extent of tightening measures already in place. He highlighted that to achieve the FOMC’s 2% inflation target, a period of below-average growth and continued labour market softening may be necessary. Importantly, he clarified that the decline in inflation had not resulted in increased unemployment.

Powell also cautioned that, without a slowdown in growth and the labour market, additional tightening measures might be required. However, he said higher long-term bond yields could naturally contribute to a tightening of financial conditions. In the context of his speech, the US 10-year bond yield experienced a notable increase, briefly exceeding the 5% threshold for the first time since 2007.

Global economic growth forecasts

The IMF forecasts global growth will slow from 3% in 2023 to 2.9% in 2024. The table below shows the annual percentage change of GDP growth in advanced economies by looking at the US, euro area, Germany, France, Italy, Spain, Japan, the UK, and Canada. Advanced economies are defined as having a high level of per capita income, a very significant degree of industrialisation, a varied export base, and a financial sector that is integrated into the global financial system. Advanced economies are forecast to expand by 1.5% for 2023 and 1.4% for 2024. Germany is the only advanced economy forecast to contract: its GDP will fall by 0.5% in 2023, but expand by 0.9% in 2024. Global inflation is forecast to decline steadily, from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024, due to tighter monetary policy aided by lower commodity prices.

| 2022 | 2023 | 2024 | |

| Advanced economies | 2.6 | 1.5 | 1.4 |

| United States | 2.1 | 2.1 | 1.5 |

| Euro area | 3.3 | 0.7 | 1.2 |

| Germany | 1.8 | -0.5 | 0.9 |

| France | 2.5 | 1.0 | 1.3 |

| Italy | 3.7 | 0.7 | 0.7 |

| Spain | 5.8 | 2.5 | 1.7 |

| Japan | 1.0 | 2.0 | 1.0 |

| United Kingdom | 4.1 | 0.5 | 0.6 |

| Canada | 3.4 | 1.3 | 1.6 |

| Other advanced economies | 2.6 | 1.8 | 2.2 |

Source: IMF, October 2023

Israeli-Palestine conflict and financial markets

Hamas launched a major attack on Israel in early October, raising concerns about a regional conflict. This resulted in a nearly 4% increase in Brent Crude Oil prices to around $88 per barrel and a 1% rise in gold prices. A hospital bombing in Gaza triggered international protests and calls for a ceasefire. Israel prepared for a potential ground operation in Gaza, with Iran threatening involvement and calling for an oil embargo on Israel, further impacting oil prices. The OPEC oil cartel rejected the suggestion of an embargo. Easing US sanctions on Venezuela helped to mitigate the oil price increase. Geopolitical tensions have had the following impact on financial markets: a hike in the oil price, which ultimately impacts the supply of oil in a region and affects prices paid by consumers. Investors also move to “safe haven assets” such as gold and Treasury Bonds to avoid incurring losses. Stock markets in the countries dependent on oil supply from the country at war are also impacted.

SA’s fiscal constraints impact growth and inflation

The SARB warned that strained public finances were obstructing economic growth. The bank suggested that reducing public debt to sustainable levels could yield benefits, including a lower cost of capital, reduced debt service costs, and lower inflation. SA is experiencing a significant revenue shortfall and a wider budget deficit, raising concerns about the country’s financial stability. Government bond yields have risen above 12%, even as inflation has decreased to 4.8%. The central bank’s inflation target range is 3-6%. Despite a forecast of 0.7% economic growth in 2023, the central bank noted spending pressures, including a growing public sector compensation bill and rising debt service costs. It also highlighted potential risks to inflation, such as the El Nino weather pattern, which could lead to drought and impact food prices. Overall, the central bank expects a gradual return of inflation to its 3-6% target range due to sticky core prices, which exclude food and energy.

Inflation dynamics in SA

SA’s recent inflation data shows a rise in the consumer price index to 5.4% in September, mainly due to soaring fuel and persistently high food prices. Core inflation, excluding food and fuel, was 4.5%, aligning with the central bank’s target. Housing costs remain subdued, a key element of core inflation, with rental inflation at 2.6%. The main inflation risks are on the supply side, such as potential food price pressures and global events, including the Israel-Hamas conflict, which impact oil prices. Importantly, load shedding is seen as less threatening to inflation due to limited household income growth, reducing demand-pull inflation pressure. In an environment where households’ income growth is limited, they may be less responsive to price changes and, as a result, less likely to drive up demand for goods and services during load shedding.

Market overview

Global overview

Global equity markets ended negatively for the third consecutive month, with the MSCI World Index at -2.9% in dollar terms, resulting in a decline of almost 10% since the end of July. Euro zone shares also underperformed, along with UK equities, in October. Short-term fixed interest rates were in positive territory, with the SteFI Composite Index ending at 1.2% month-on-month (m/m) in dollar terms. Global Bonds ended in negative territory at -1.2% m/m and Global Property was also negative at -4.75% m/m. Emerging markets underperformed, with the MSCI Emerging Markets Index ending the month at -3.88% m/m in dollar terms. The Dow Jones declined to end the month at -1.26% and the S&P 500 also ended the month negatively at -2.1%, both in dollar terms.

Local overview

The South African equity market matched global equity markets in producing a third consecutive negative month in October. The FTSE/JSE All Share Index fell -3.44% m/m in rand terms, dragging the bourse further into negative territory at -1.33% year-to-date (YTD). The JSE Top 40 also underperformed, ending the month at -3.67%. Industrials ended the month at -4.58% but are in positive territory for the year to date, at 5.64%. Resources were also negative for the month, ending at -4.31%, and Property was -2.98%. Financials were down -2.15% m/m, but Cash ended positively at 0.7%. The rand gained by 0.49% m/m against the US dollar, 0.66% m/m against the euro, 1.08% m/m against the British pound, 0.54% against the Japanese yen and 0.003% against the Australian dollar. In the bond market, the FTSE/JSE All Bond Index ended in positive territory at 1.71%, with bonds of 1-3 years ending the month positively at 1.07%. Bonds of 3-7 years ended the month at 1.32%, with bonds of 7-12 years at 1.79% and bonds of over 12 years at 1.99%.

Comments are closed.